They may not know exactly what is bought, but government and education officials have a keen eye on purchases made in Liberty County.

That’s because they receive a portion of tax revenue generated from most sales, and Liberty County capital-projects coordinator Tammy Richey said the numbers have been too variable lately to make earnings predictions or to speculate how the local economy is faring.

“When people ask me how (special-purpose local option sales tax) is looking, I always tell them, ‘Call me next month, and I’ll tell you whether it’s up or down,’” Richey said.

That’s because she’s awaiting several months of consistent collections, which has not happened in about 15 months.

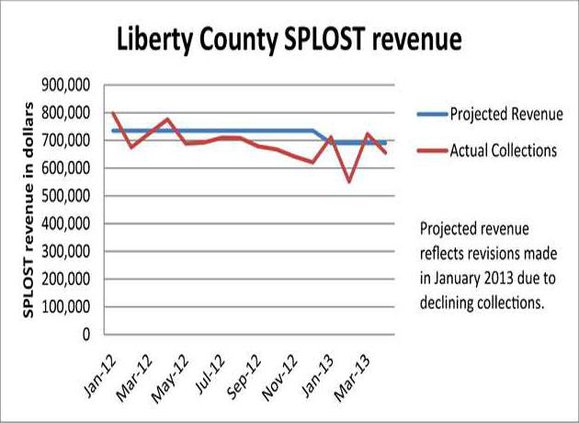

As a result, Richey reported to the Liberty County Board of Commissioners in February that SPLOST collections have fallen short of predictions over several months, a concerning trend that could limit future capital projects.

More recently, however, the figures seemed to trend upward — but they’ve fallen again.

The county’s collected SPLOST revenue has been consistently below projections since April 2012, when they received $775,493 over a projected $734,832, according to numbers provided by Richey.

Richey’s numbers are captured on a delay because the data has been historically tracked that way, she said. More current figures are available online through the Georgia Department of Revenue.

Collections since have varied but always fell short of the $734,832 projection. In January, the Department of Revenue reports the county received $711,874. The number fell in February to $551,127, but rose again in March to $722,868, the highest collection since April 2012, when the county received $775,439.

Collections fell again to $665,223 in April.

Where the money goes

Liberty County collects 1 percent of sales tax under SPLOST, a voter-approved tax that funds capital projects such as the Liberty County Justice Center and the Liberty County Community Complex under construction in Midway.

The current tax began in 2009 and will expire in 2015. When the tax was adopted, the area was projected to receive $51.5 million in revenue over five years, but Richey in February revised the projection to $48.8 million.

A new facility for the Live Oak Public Libraries Hinesville branch also is to be funded by SPLOST.

The Liberty County Board of Education tracks collections on its own version, called E-SPLOST, where a 1 percent sales tax funds projects such as renovations at Bradwell Institute, the Performing Arts Center and Olvey Field.

Jason Rogers, Liberty County School System’s assistant superintendent for administrative services, has updated the board on SPLOST collections.

Board of education and county SPLOST collections historically should have been identical, but a state law that took effect Jan. 1 exempts excise tax on transactions for energy sold to manufacturers. That exemption, however, does not apply to E-SPLOST, which means the board of education likely will collect slightly more than the county as reflected in recent months, according to Georgia Department of Revenue spokesman Jud Seymour.

Rogers reported that February collections, which reflect January consumer purchases, were $551,332.

“Which was quite alarming, because February of last year, the collections were $675,044, then we were pleased because in March they jumped back up to $725,998, which was pretty much in line with that same month last year,” Rogers said.

But for April, E-SPLOST collections fell to $667,236, weaker numbers than in April 2012, when the BoE collected $727,167.

“The volatility of the collections causes us to have to budget on a more conservative level, which then, we have to take into account what we’re going to plan for next year, and really prioritize those and take care of what the board feels is the most important first,” Rogers said.

It also requires the BoE to time the projects to coincide with revenue distributions because they operate on a cash basis. During a Tuesday budget session, the board prioritized $5,185,400 in school improvements and modifications for the 2014 fiscal year.

Rogers said they also are considering technology enhancements and possible bus refurbishments.

Local municipalities also receive a portion of 1 percent of sales taxes under LOST, or local option sales tax. Those funds can contribute to the operating budgets of qualifying governments, such as Hinesville, Walthourville, Midway, Riceboro, Flemington and the county.

Allenhurst and Gum Branch do not meet the service-delivery requirements to qualify for LOST revenue.

Cause for variability

It’s possible the fluctuations in revenue distributions are a reflection of consumer habits changing month-to-month, especially with variables like impending Department of Defense furloughs having uncertain effects on the area.

But Liberty County Administrator Joey Brown said officials here and in other counties are concerned the inconsistencies could be related to GDOR distribution patterns.

“I concur with Mr. Brown on this,” Richey said. “The state collects the taxes — and we’re nowhere saying that somewhere there’s something off — but a lot of counties, we do all notice that we may receive $500,000 one month, and the next month we may get $700,000.”

That means future impacts remain uncertain.

“It’s just a monster right now that’s really not predictable,” Richey said. “I can tell you that as far as our projections and what we’ve received to date, we’re still in our target goal, but I can see that number fading, too, every month if you don’t meet that collection that you’re projected.”

SPLOST collections too erratic to predict

Sign up for our e-newsletters