The Liberty County Board of Commissioners held the first of three millage-rate hearings Monday, even though the 12.58 millage rate — for unincorporated and small cities — will not change. The county is required by law to advertise the millage rate and hold three hearings because it will keep revenue generated from reassessed growth, county officials explained. The county will hold the second and final millage rate hearings at noon and 6 p.m. Tuesday, Dec. 3, at the Liberty County courthouse annex in Hinesville.

Liberty County Commission Chairman Donald Lovette, commissioners Marion Stevens and Connie Thrift, Assistant County Administrator Bob Sprinkel, County Finance Director Kim McGlothlin, Liberty County Development Authority Director of Administration and Finance Carmen Cole and one interested resident were present at the mid-day hearing.

“The only people who may see a slight change are those whose values increased because of additions to their real property or because the value of their homes increased due to reassessment, i.e. (their) property was determined to be worth more,” County Administrator Joey Brown said via email.

“A lot of the residential properties did not increase (in assessed value),” McGlothlin said. “But a lot of the commercial and industrial properties did increase.”

She said most of the $6.9 million that will be generated by reassessments is from new or expanded commercial, retail or industrial properties. She added a lot of commercial property inside the city of Hinesville was reassessed last year, and a number of industries in Midway did not receive exemptions this past year as in years past.

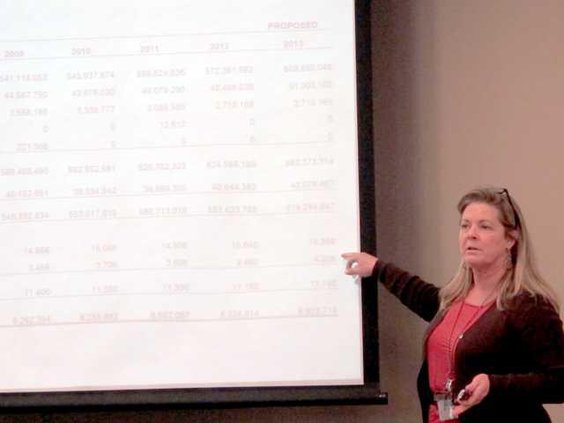

The county finance director briefed commissioners on how property-tax revenue is used. She said this money pays for necessary services the county provides its residents. Sixty-seven percent of the county’s budget, or close to $18 million, goes toward mandated services such as public safety and the courts. Thirty-one percent goes toward essential services, such as permitting and licensing, and 2 percent is earmarked for discretionary funds like grant programs, according to McGlothlin.

The finance director said the tax digest shows $46 million was generated by real growth and $12 million was generated by reassessed properties, so the combined growth comes to $58.9 million.

Lovette said the county tax assessor is required by the state to reassess properties periodically or face steep fines.

McGlothlin said the county has a 96 percent property-tax collection rate, and the county’s operating budget is based on estimated property-tax revenue.

The county adopted a $26.4 million general-fund budget last June, according to the finance director. County department heads were directed to reduce their budgets by 5 percent, she said.

Lovette said that was not an easy task, since most county department budgets already were “lean and mean.”

The finance director stressed the county cannot require constitutional officers, like the sheriff, to cut their budgets.

“We can only ask,” she said.

After departmental budget cuts were made, the county adjusted its general-fund budget down to $26.308 million, McGlothlin said.

She added the county did consider less desirable ways of making budgets cuts, including furloughs, eliminating services, layoffs and decreasing employee benefits. The finance director said some positions have been eliminated and several capitol requests were denied.

Stevens said county employees have not received pay raises in the past three to four years.

“We have done due diligence to shelter taxpayers’ money,” he said.

County holds millage rate at 12.58 mills

State requires it be called tax increase

Sign up for our e-newsletters