If you are a cancer patient and live on the Georgia coast outside Chatham County, chances are you drive to Savannah, Jacksonville or another metropolitan area if you need chemotherapy.

But thanks to Georgia’s new Rural Hospital Tax Credit Program, Liberty Regional Medical Center has generated $850,000 in donations to launch a new oncology facility that will include an infusion center so residents of Liberty and Long counties who need treatment can stay close to home.

And in the suburbs of Savannah, tax credit donations totaling $670,000 are enabling Effingham Health System to renovate the hospitals’ 50-year-old inpatient unit and fund a new cancer treatment center.

These two hospitals are among 58 hospitals across the state awarded an average of $600,000 to $1.5 million under Georgia’s Rural Hospital Tax Credit Program. The new plan is so popular that donations quickly reached the $60 million cap in early July.

Wayne Memorial Hospital in Jesup also earned $680,000 under the tax credit program. That hospital is using its new money to purchase operating room and imaging equipment.

With so many small community hospitals across south Georgia struggling to find funds to make improvements to their hospitals or even keep their doors open, this tax credit program is proving to be a winner across the state as citizens and local businesses are stepping up to donate to their local hospital. In exchange for their donations, they get a tax credit on the Georgia state income taxes.

Under the program, a single filer in Georgia may get 100 percent income tax credit of a donation up to $5,000. Those filing married and jointly may get a 100 percent credit up to $10,000. Those that file as C corps get a 100 percent tax credit equal to the amount of the contribution, or 75 percent of corporation or trust’s income tax liability – whichever is less.

With so many donors wanting to contribute but unable, Georgia lawmakers should grow this program to $100 million next year. Across Georgia, the new tax credit funds are being used to purchase new nurse call systems for patients in hospital beds, construct new mother-baby birthing units, new doctors’ offices, build new hospital wings and purchase diagnostic equipment among other items.

This program goes beyond charity. Purchasing equipment and offering new services geared toward helping patients also helps rural hospitals leverage new revenue streams and keeps them from having to refer patients to big cities like Atlanta for expensive testing and treatment. Better, more local treatments for patients results in improved fiscal health for smaller hospitals.

What is best about this program is that instead of raising state or local taxes to help rural and community hospitals, citizens and businesses are stepping up to do their part and donate their own money. They believe in the mission of their local hospital and are willing to help improve their community medical center so it can offer hi-tech medical care in communities where patients have disproportionately poorer health outcomes.

This tax credit is what I like to call a function of the “Four Cs” – relying on churches, charities, citizens and corporations to help solve our state’s challenges. Instead of increasing the tax burden on all citizens or growing government programs with no strategic end-game, these citizens and corporations want to help solve their own community needs and will likely see a great return on their investment.

Since 2001, more than eight rural hospitals have closed in Georgia. It’s good to know that more and more of these hospitals will now have the necessary funds so that if a loved one needs specialized medical care they will find some of the best treatment in their own community. Let’s keep moving toward improved healthcare outcomes in 2019 by allowing more a lot more Georgians to donate to their local hospital and get a tax credit for doing it.

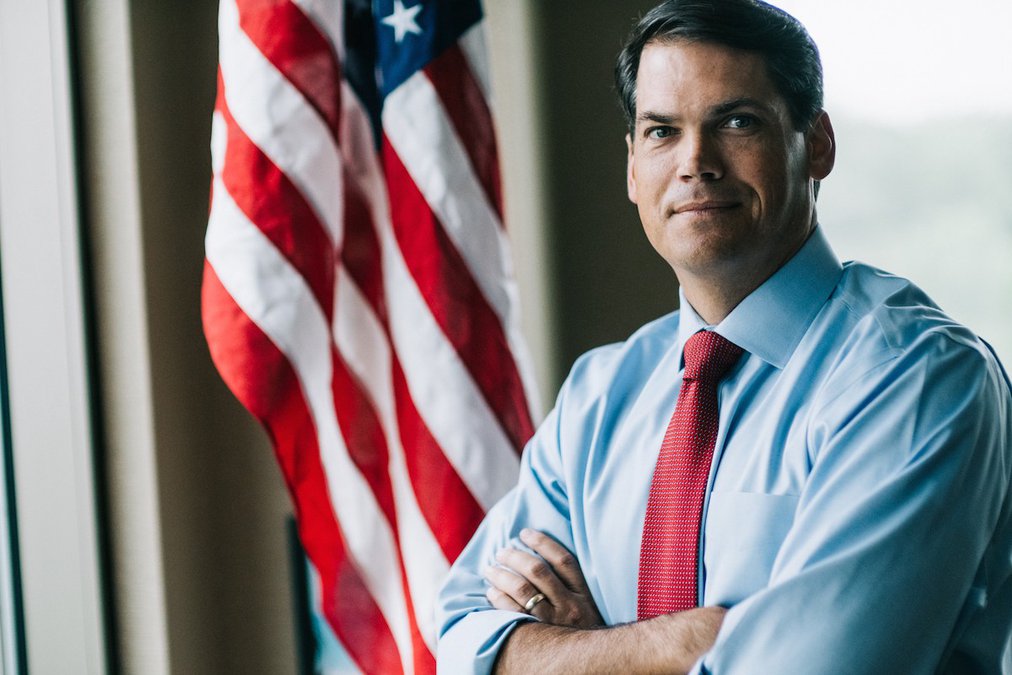

Duncan, a former state representative from Cumming, small businessman and former pitcher for the Florida Marlins organization, authored the Georgia Rural Hospital Tax Credit Program. He is the GOP nominee for lieutenant governor.